Best Private Equity CRM Tools for 2025 — and Why You Still Need Extruct

Discover how Extruct enhances top PE CRM platforms by adding thesis-driven data enrichment, custom signals, and automated research to drive better investment decisions.

Private equity CRM solutions are table stakes for any private equity firm managing active pipelines, LP communications, or portfolio updates. These tools are essential for private equity firms to streamline operations and enhance investor relations. But here's the thing: no matter how slick your CRM is, it's only as good as the data inside it.

That's where most platforms fall short. They organize what you already know—but they don't surface the things you don't. The nuances. The live changes. The custom signals that actually drive conviction.

Let's break it down.

Top Private Equity CRM Software Platforms for 2025

Here are the best private equity CRMs everyone in private markets seems to be talking about this year—each strong in its own domain. Private equity CRM software is essential for managing investor relationships, portfolio information, and deal flow, automating reporting and investor updates to enable firms to focus on strategic activities that drive deal success.

1. DealCloud

Probably the most widely adopted among mid-market PE firms. Built for private capital markets. Tracks deals, contacts, touchpoints, and reporting workflows. Solid if you've got a team dedicated to keeping it updated. DealCloud excels in pipeline management, optimizing deal flows and managing various stages of deals to enhance overall efficiency. Additionally, DealCloud enhances the deal making process by streamlining various stages of deal-making, improving communication with investors, and providing valuable data to optimize deal flow and relationship management.

2. Affinity

Built around relationship intelligence, Affinity automatically pulls in email and calendar data to map networks and help you see who-knows-who. Great for sourcing through warm intros. Affinity is also widely used in investment banking, providing tools to manage contacts, deal pipelines, and investor relations effectively.

We integrate directly with Affinity, enriching your firm and contact records with custom data points based on your thesis. So instead of wasting time Googling during pipeline review, you get deal-critical context right in your CRM. Affinity also excels in nurturing relationships, ensuring you maintain and strengthen key connections to enhance deal flow and achieve competitive advantages.

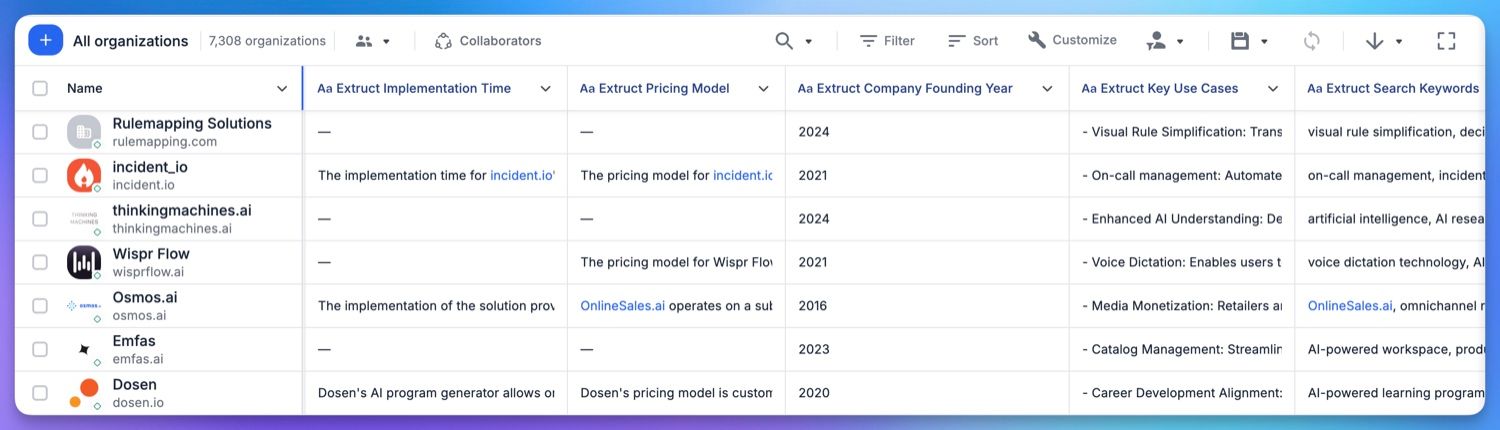

Extruct seamlessly integrates with Affinity CRM, enhancing company records with custom data points tailored to your investment thesis.

Extruct seamlessly integrates with Affinity CRM, enhancing company records with custom data points tailored to your investment thesis.

3. 4Degrees

Created by ex-investors, 4Degrees focuses on automating relationship tracking and scoring. 4Degrees also supports the capital raising process by centralizing information and streamlining communications with potential investors. It's lightweight, modern, and built with sourcing in mind.

Additionally, 4Degrees supports business development processes by enhancing customer relationship management and deal tracking, which are crucial for scaling operations and maintaining competitive advantages.

4. Altvia

Runs on top of Salesforce CRM, so it's flexible but needs admin support to get the most out of it. Altvia helps firms track deal flow efficiently, ensuring that all stages of the investment process are well-managed and documented. Handles fundraising, LP comms, and internal dashboards. Best suited for firms already deep into the Salesforce ecosystem.

5. Dynamo Software

Popular with fund managers and portfolio managers who want everything in one place—deals, LP data, portfolio company KPIs. Dynamo Software excels in managing deal pipelines, helping firms streamline their deal sourcing and execution processes. Especially useful for multi-strategy platforms managing credit, VC, and PE.

For firms researching potential investments, our guide to private equity research provides additional methodologies to enhance your CRM data with deeper insights.

What These CRMs Get Right (And What They Miss)

All of these platforms are excellent at:

-

Structuring deal flow

-

Organizing contacts

-

Automating email sync and notes

-

Managing investor interactions

These platforms also help reduce the burden of manual data entry, allowing firms to focus on more strategic activities.

But here's what they don't do:

-

🔍 Surface new targets aligned with your thesis

-

📊 Deliver research-grade data points beyond firmographics

-

🧠 Automate the grunt work of sourcing and qualification

That's why we built Extruct. Our CRM system also emphasizes the importance of automated data capture, which not only streamlines data entry but also enhances deal management and relationship intelligence.

When it comes to identifying potential investments, our New York private equity firms resource showcases how targeted data can enhance your deal sourcing process.

Why Extruct Complements Your CRM — Not Replaces It

Most CRMs are where you store data.

Extruct is how you get the right data in the first place. Extruct integrates various data sources to enhance CRM functionality for private equity and other financial services firms.

Here's what Extruct adds to your stack

✅ Live company discovery

Describe the kind of companies you want to find ("founder-led logistics tech companies growing >20% YoY in Europe") — Extruct crawls and delivers a structured list.

✅ Custom enrichment, not just firmographics

CRMs give you size, location, and sector. We add things like pricing model, tech stack, hiring signals, expansion history, and sales channels — tailored to your thesis.

✅ Direct Affinity integration

Our clients use Extruct to automatically enrich records inside Affinity with custom fields, so you're not bouncing between browser tabs during IC prep. Extruct also integrates seamlessly with Microsoft Dynamics, providing a unified platform experience for firms using Microsoft enterprise applications.

✅ Data that drives decisions

We're not just filling in blanks. We're giving you context to act—on which deals to prioritize, which founders to reach out to, and which targets are heating up. Extruct provides actionable insights for decision-making.

Our investors & consultants solution provides additional tools specifically designed for private equity firms looking to enhance their CRM data with deeper insights.

The Takeaway

Choosing the right CRM helps you run a tighter process.

Using Extruct ensures that process is filled with better data.

In 2025, the edge won't come from having the fanciest dashboards. It'll come from:

-

Finding the right companies before others do

-

Making decisions based on the right data

-

Spending less time on research, and more on conviction

The right CRM can enhance the entire investment lifecycle by improving investor relations, streamlining operations through workflow automation, and providing data insights from initiation to closing.

Use DealCloud. Use Affinity. Use Dynamo.

But if you want your pipeline to be smarter, faster, and thesis-driven – plug in Extruct.

Ready to see how Extruct can supercharge your private equity CRM with better data and automated research? Schedule a personalized demo to see the Affinity integration in action and discover how we can customize our platform to match your firm's unique investment thesis.

Dimitri Persiianov

Dimitri Persiianov